FOREX. What is PAMM account?

FOREX is an international currency market or in other words trading with foreign exchange. You can find many articles about Forex and Forex trading at financnik.cz. I suppose many of you have heard about Forex and some you even tried trading Forex.

Unfortunately, most of you probably gained a negative experience and in the worst cases it meant losing your account (this actually is my experience with most of the traders I met and most of them already paid this so called „tuition fee“). In my early Forex trading years I also lost a few accounts and paid my own tuition fee. Fortunately, it was always money that I did not need and I could afford to lose. After I came to lose my third trading account, I finally realized what Forex was all about and how to trade forex to make money. Most of the people I had chance to talk about Forex trading lost their trading accounts repeatedly and never learned to earn money on this market. My personal statistic says that this was case for 8-9 people out of 10. Additionally, many traders who trade FOREX claim that they earn money on forex, but the opposite is true.

Advice to novice traders.

Before you open your first LIVE trading account, take a look at the following:

- Read as much as possible about Forex trading, learn about technical and fundamental analysis, learn to read and follow economic calendar.

- Find yourself serious and reliable broker.

- Get to know your trading platform as much in details as possible.

- Attend couple of at least basic and intermediary trading seminars.

- Trade firstly with your DEMO trading account (Do not worry, you won’t miss anything).

- Find yourself a mentor – trader with real trading experience, who lives out of trading (I consider this to be the most important as well as most difficult part).

- Set up the right money management.

Do not ever start your trading journey with LIVE trading. Do not trade your last money, savings and money lent from a bank or a creditor or even a friend. Additionally, insufficient size of your trading account can cause loss of your account, too. Moreover, in 95% cases out of 100%. Diversify. Hedge your risk investment on Forex with real values such as investment gold and silver ideally following the 1:1 ratio. Alway count on the option that the market and every market participant can trade against you, therefore, adjust your trading strategy, number and volume of trades opened. Do not be greedy. Be humble and patient trader. Making profit of 1-4% of your account size can lead you to success without losing your money and trade safely. A trader which claims to earn 10% and more monthly profits is probably gambling on roulette and it is only a matter of time till he losses his funds at all. I might add more articles on this topic and about Forex in my future posts.What is PAMM account?

PAMM account is a trading account or trading service which allows you to invest collectively into investment projects or accounts offering investment trading services on Foreign exchange. An investor gets opportunity to make investment to PAMM trading account managed by a professional trader and gets a share of this PAMM account. Be careful, it is not always professional trader running a PAMM project.

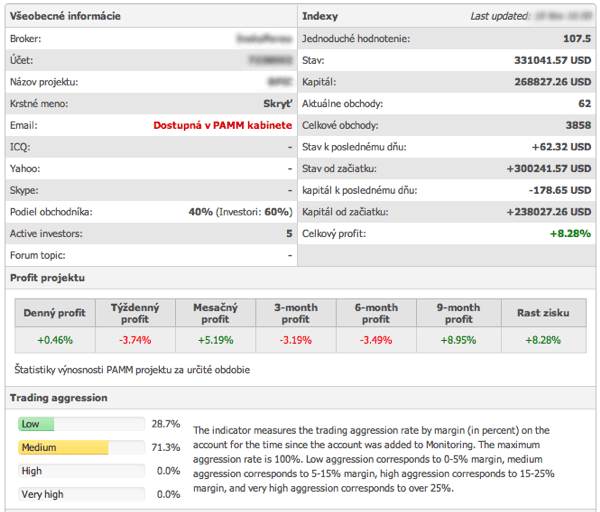

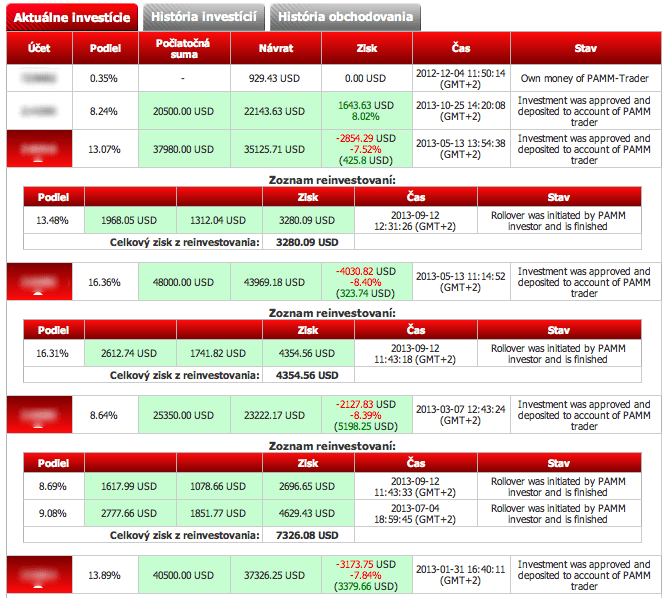

PAMM accounts are used by investors who want to invest their funds to accounts of professional traders in order to get portion of profit made by trades of a pamm trader. To find serious pamm trader, you have to look for pamm accounts set up and controlled by a company (broker). After PAMM investor invests funds to chosen PAMM account, Pamm investor becomes shareholder of this particular Pamm account managed by Pamm trader in proportion to the size of his investment.PAMM account overview

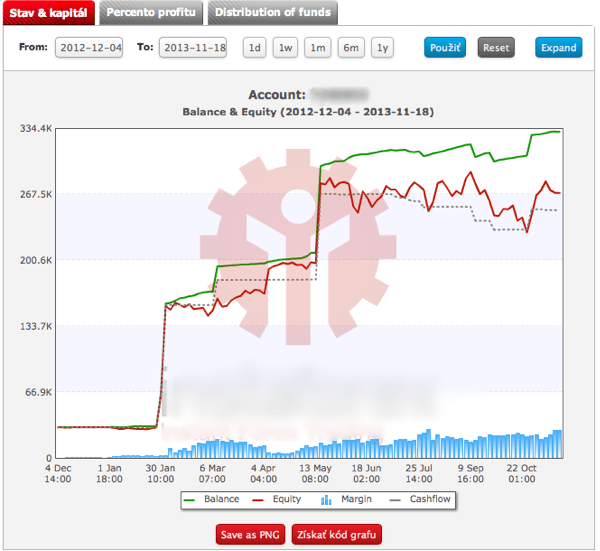

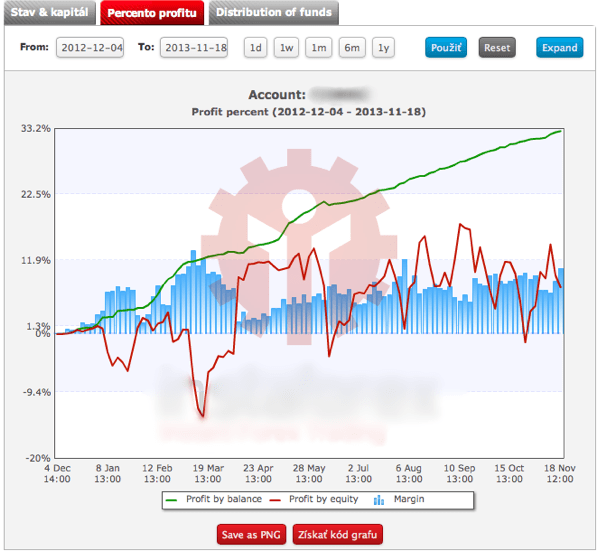

Brokers which offer pamm accounts opening to traders and professional managers provide automated software which allows all pamm investors deposit, withdraw funds, watch current trades and overall situation at the pamm account, its history, profit percentage, trading aggression, number of deposits and withdrawals by all other shareholders and much more.

Who can invest with PAMM accounts?

Every investor, who opens LIVE trading account with a broker offering managed PAMM accounts portfolio, can invest with PAMM account. My advice to all investors is to study chosen Pamm accounts in great detail before making an investment. Also, read carefully all conditions set by pamm trader, trading aggression and history of trades as well as deposits and withdrawals. Do not ever invest into pamm account with LIVE trading history shorter than 9 to 12 months. Further, avoid those with high aggression (margin use at 15-25%) and very high aggression (margin use at 25% and more). In other words, if a pamm account shows 25-30% of floating loss in the long term, investors should consider investing into such pamm account.

What is the minimum required amount for investing into PAMM?

Minimum deposit amount at Pamm account is always set by a Pamm trader. Some Pamm accounts accept investment as low as USD 1 or EUR to any amount. Every investor should consider the amount invested. The reasons are banking fees when depositing and withdrawing, brokerage fees and also profit share of pamm trader which can help you to the right sum to be invested. Sometimes USD 1000 might not be worth it. Ideal investment size would be somewhere between USD 10 000 to 30 000 (EUR). Every Pamm account can accept unlimited number of investments and unlimited number of investors. Though, Pamm account manager has a right to deny any investment if he considers to be appropriate so.

Are PAMM investments bound by any terms and conditions? What is the minimum investment period?

Minimum investment period can vary from Pamm trader to Pamm trader. Settings at Pamm account depend on the number of pamm investors in one pamm account, sum of all investments and trading strategy of the Pamm account manager. Minimum period of investment can be 0 to 90 days. During this period an investor can withdraw his initial pamm investment only at a cost of sanction set by Pamm manager. In my opinion, it is better both for Pamm trader and pamm investor if this period is maximum possible. Such a pamm account can become more stabile, pamm trader is not stressed about any day withdrawal as he can plan carefully how to set up his trading strategy. Unexpected withdrawals can also put other pamm shareholders in risk. After the initial period has gone, investors can withdraw anytime without sanction. Nevertheless, there normally is a gentlemen agreement between Pamm investor and Pamm trader that the investor should inform trader at least 1-6 months ahead of his withdrawal. This way, any withdrawal will not put Pamm account into any possible trouble, pamm trader’s strategy can keep its original route and all pamm investments can be safe.

What interest can I make on my investment and what profit share does a PAMM trader get?

Pamm trader should be trading as less risky as possible. Such trader can be considered as serious manager and might be still trading his portfoliio in the next 2, 3 or 5 years. You do not want to see your investment to be lost within half a year or even earlier. Serious Pamm trader makes 1-4% monthly return on investment, which means 12 to 50% annually. Results are also affected by market volatility which cannot be influenced by pamm trader. Investor’s profit can be withdrawn on monthly, quarterly, biannual or annual. In some cases, withdrawal can be processed at the time profit is made. Often it is upon agreement between investor and trader. Pamm trader gets his share of profit once pamm investor withdraws his profit. Profit is being divided automatically by the system to all participants. Pamm trader’s profit share can range from 10 – 50% of your profit being withdrawn. The better the Pamm manager, the higher his fee normally is. Though, even if your trader makes you 30% annual profit and let’s suppose his share on profit is 15%, it should be still reasonable result if you compare this result to any banking products on offer.

Can I lose my initial investment?

You can always lose your investment. Though, You should remember that every time you are about to make any investment, deposit money somewhere or starting your new business. Your money are not safe even at banks nowadays. The same applies for Forex. For these reasons, you should enter Forex with your investments only with funds you can afford to lose. It should not be your only money. In order to not lose your investment in Pamm account, you can minimize this risk by choosing the right pamm account with the professional pamm trader. The best you can do is to know personally your pamm trader as well as the history of the chosen pamm account. Further, even if you find the right pamm account with great pamm trader, no one can guarantee you that markets won’t fall. If this situation occurs and you do not own any hedge investments such as investment gold and silver, it is probable that you can lose your investment.

It is important to withdraw your profits regularly. Do not add your profits to your principal. The vision of larger principal might be getting you more interest might not work for you. Until you withdraw the amount of your principal, I do not suggest to add profits to your principal neither once nor repeatedly. Once you withdraw your profits, you can regularly buy precious metals, market price of which would rise sharply in case of markets fall. Eventually, it could cover your potential loss on Forex.